In a Crisis, Use Lean Competitive Analysis

Many of our clients have been asking us for advice on how to stay competitive in this rapidly changing world. Customer behavior is changing rapidly and, if they are financially healthy, your competitors are likely innovating to adapt to these changes. Other competitors may be struggling and could become acquisition targets for you to bring on new assets or new customers or both. How do we stay on top of all this?

Enter: Lean competitive analysis

Just like lean startup or lean product methods, lean competitive analysis is designed to help you quickly monitor and analyze competitor actions. It is not the type of competitive analysis you would do if you were refreshing a three-year strategic plan, nor is it what we see a lot of companies doing right now, which is no competitor analysis.

I’m still surprised how many companies run down the innovation path without a quick hygiene check on the competitive landscape. A CEO gets excited about a new idea or your sales team comes to you promising that people will buy. Boom! You are off and running, only to watch the product flounder in the market after months of long days and heartache.

What is ‘typical’ competitive analysis?

Typical competitive analysis is about developing a rich understanding of who is doing what in your market space. It answers questions such as:

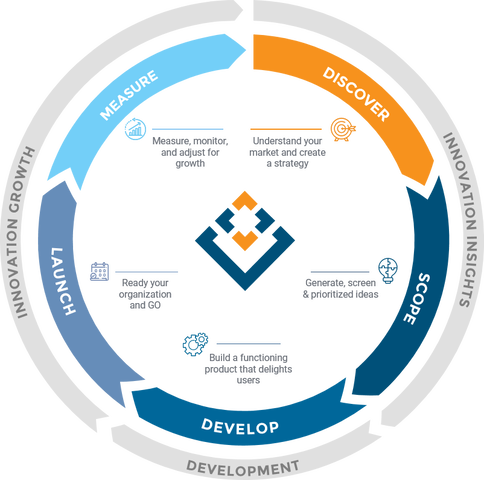

In lean competitor analysis, we narrow this question list based on your end goal. What are you trying to learn? Or in Vecteris terms, where are you on the Innovation Pathway?

Enter: Lean competitive analysis

Just like lean startup or lean product methods, lean competitive analysis is designed to help you quickly monitor and analyze competitor actions. It is not the type of competitive analysis you would do if you were refreshing a three-year strategic plan, nor is it what we see a lot of companies doing right now, which is no competitor analysis.

I’m still surprised how many companies run down the innovation path without a quick hygiene check on the competitive landscape. A CEO gets excited about a new idea or your sales team comes to you promising that people will buy. Boom! You are off and running, only to watch the product flounder in the market after months of long days and heartache.

What is ‘typical’ competitive analysis?

Typical competitive analysis is about developing a rich understanding of who is doing what in your market space. It answers questions such as:

- What is each competitor’s value proposition and positioning?

- What products or services do they sell? Features? Benefits?

- What is each competitor’s profile (# employees, revenue, public/private, etc.)?

- What is each competitor's market share?

- Who is each competitor's target market/audience/user?

- How do they market their products or services?

- What are their strengths and weaknesses?

- What potential threats do your competitors pose?

- What potential opportunities do they make available for you? (Where is the white space?)

In lean competitor analysis, we narrow this question list based on your end goal. What are you trying to learn? Or in Vecteris terms, where are you on the Innovation Pathway?

Where are you on the Innovation Pathway?

Are you in the discover and scope stage before building a new product? If so, focus on competitors serving your target market. This means traditional competitors as well as brand new ones who are serving the same customers and addressing the same problems but with completely different solutions. A lot of ‘digital-only’ companies may emerge on your competitor scan.

Ask are they efficiently solving your customers' most unique and expensive problems? Where is the "white space" — real customer problems that aren't being addressed by your competitors?

For example, recently, a client in the healthcare industry engaged our support for the first phase of the Innovation Pathway (Discover & Scope). Their executive team was considering a large investment in a new product and wanted us to do a deep dive on new digital-only entrants, not their typical competitors. They needed to understand how well these new entrants were solving the same customer problem and how much was start-up hype. Our competitive analysis gave the board the confidence to take the next step to build a Minimum Viable Product.

In the Launch phase, we focus competitor analysis on pricing, positioning, packaging, and promotion (our version of the 4Ps). For another client in this phase of the Innovation Pathway we used competitive analysis to create a sales enablement toolkit including a pitch deck that clearly differentiated them from competitors and a sales “cheat sheet” on how to differentiate their offering versus specific competitors. These tools gave the sales team greater confidence in the product.

How to do lean competitive analysis well

The first step is to identify all the players. You may know some of the traditional competitor names. Resources like CB Insights, Owler, and Capterra (for tech products) can help you identify others. Advisors, investors, and a few customer interviews are also great sources for competitive information. Start with an exhaustive list of everyone in the space, but then do a quick competitive scan to cut the list down to just a handful of the companies that seem to compete with you the most.

Next, take a deep dive into the shortlist. Secondary sources are suitable for a first dive into the tangible and intangible assets, capabilities, níche, and current market positions. You can check advertising, sales brochures, news coverage (mainstream and business press), annual reports, trade associations, or one of the many business databases with paid walls (such as Hoovers). Social media and company websites also reveal a lot about brand identity and marketing strategies. You can go so far as to sign up for competitors’ newsletters or subscribe to their blog.

Once the data is collected, you have to analyze it and compare it to your own. There are many ways this can be done. You could conduct a SWOT Analysis to evaluate their strengths, weaknesses, opportunities, and threats. Whatever your approach, be sure to run your own business or idea through the same method you used to assess your competitors (i.e., take an objective look at your structure, sales, and marketing efforts, etc., using the same metrics).

We recommend that you continue to monitor your competitors through the rest of your journey through the Innovation Pathway. Refresh the analysis quarterly. Consider tracking metrics that speak to:

What strategies have you used for lean competitive analysis? What worked well to get you the information you needed? If you have questions about how to structure your next competitive analysis, don't hesitate to reach out.

Are you in the discover and scope stage before building a new product? If so, focus on competitors serving your target market. This means traditional competitors as well as brand new ones who are serving the same customers and addressing the same problems but with completely different solutions. A lot of ‘digital-only’ companies may emerge on your competitor scan.

Ask are they efficiently solving your customers' most unique and expensive problems? Where is the "white space" — real customer problems that aren't being addressed by your competitors?

For example, recently, a client in the healthcare industry engaged our support for the first phase of the Innovation Pathway (Discover & Scope). Their executive team was considering a large investment in a new product and wanted us to do a deep dive on new digital-only entrants, not their typical competitors. They needed to understand how well these new entrants were solving the same customer problem and how much was start-up hype. Our competitive analysis gave the board the confidence to take the next step to build a Minimum Viable Product.

In the Launch phase, we focus competitor analysis on pricing, positioning, packaging, and promotion (our version of the 4Ps). For another client in this phase of the Innovation Pathway we used competitive analysis to create a sales enablement toolkit including a pitch deck that clearly differentiated them from competitors and a sales “cheat sheet” on how to differentiate their offering versus specific competitors. These tools gave the sales team greater confidence in the product.

How to do lean competitive analysis well

The first step is to identify all the players. You may know some of the traditional competitor names. Resources like CB Insights, Owler, and Capterra (for tech products) can help you identify others. Advisors, investors, and a few customer interviews are also great sources for competitive information. Start with an exhaustive list of everyone in the space, but then do a quick competitive scan to cut the list down to just a handful of the companies that seem to compete with you the most.

Next, take a deep dive into the shortlist. Secondary sources are suitable for a first dive into the tangible and intangible assets, capabilities, níche, and current market positions. You can check advertising, sales brochures, news coverage (mainstream and business press), annual reports, trade associations, or one of the many business databases with paid walls (such as Hoovers). Social media and company websites also reveal a lot about brand identity and marketing strategies. You can go so far as to sign up for competitors’ newsletters or subscribe to their blog.

Once the data is collected, you have to analyze it and compare it to your own. There are many ways this can be done. You could conduct a SWOT Analysis to evaluate their strengths, weaknesses, opportunities, and threats. Whatever your approach, be sure to run your own business or idea through the same method you used to assess your competitors (i.e., take an objective look at your structure, sales, and marketing efforts, etc., using the same metrics).

We recommend that you continue to monitor your competitors through the rest of your journey through the Innovation Pathway. Refresh the analysis quarterly. Consider tracking metrics that speak to:

- Company health such as changes in company size (revenue and employees), changes in primary investors, new patents, etc.,

- Key product performance metrics from the customer perspective such as price, quality, delivery, ease of use

- Marketing strategies such as content channels and content quality

What strategies have you used for lean competitive analysis? What worked well to get you the information you needed? If you have questions about how to structure your next competitive analysis, don't hesitate to reach out.