Setting New Product Budgets for 2022

Fall is my favorite time of year. The kids go back to school (thank goodness), leaves change colors, pumpkin spice returns AND, for many organizations, budgeting season kicks off! As a Type-A planner, I love budgeting season because it's where we translate our vision and strategy into tangible spending commitments for the upcoming year.

As a product innovation consultancy, we are often asked to weigh in on how to set and allocate new product innovation budgets. In other words, helping organizations decide how much to invest in developing, launching, and maintaining new products.

Being very deliberate about funding and resourcing is a critical part of successful innovation. This includes deciding how much to invest in incremental vs. transformational innovation and which ideas to fund. As many of us enter budgeting season, I want to share the tactics I’ve seen work well in making these decisions. These include:

- Separating existing product improvement opportunities from new product investment decisions and creating different budgets for each

- Scoring new product investment opportunities using a clear set of criteria

- Looking at the totality of ideas to ensure there is a strategically balanced mix of “easy wins” and longer-term transformational ideas

- Revisiting the assumptions we’ve used to make these decisions at least quarterly, and re-prioritizing as needed

Here is a little more detail on each:

1. Separate existing product improvement opportunities from new product investment decisions and create different budgets for each

Evaluating innovation investment decisions as part of existing “operational” budgets rarely works because new products almost always lose out to investment in existing products and services. This is because new products have less certainty and are less likely to have meaningful revenue (and even less profit) in the near term.

We recommend creating a separate budget for new product development. The size of the budget typically depends on the amount of digital disruption a company is facing. It’s important to note that research studies have found no relationship between the size of innovation budget and innovation success. What matters is how effectively we spend our budgets. That’s why we also recommend establishing an independent “product innovation board” to review and govern the new product development budget. The group should receive regular updates about new product development and launch progress and make go or no-go decisions on additional investment.

2. Score investment opportunities using a clear set of criteria

The leadership team will need to agree on the criteria to use to evaluate each idea and agree on the definition for each. Typical criteria include metrics such as revenue potential (near-term and longer-term), payback period, and the ability to attract new customers. Whatever metrics we choose, we all have to agree and work from the same definition of each. For example, if one of the metrics is "ability to implement", how is this assessed? Time to implement? Level of change required? Number of new capabilities needed? All of the above?

These prioritization frameworks can be as complicated or as simple as we want. I’ll share two prioritization methods that we’ve seen work well for our clients.

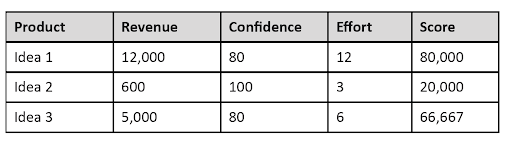

Revenue, Confidence & Effort

For organizations that are just getting started, a straightforward framework for evaluating ideas is recommended. Many organizations look at Revenue, Confidence, and Effort which is a variation of the RICE method39 (Reach, Impact, Confidence, and Effort). The simplified method includes:

- Revenue: an estimate of sales with assumptions around price and volume.

- Confidence level: how sure are you that the idea will yield the estimated revenue? (High = 100 percent, Medium = 75 percent, Low = 50 percent)

- Effort: how much time, money, and other resources will it take to create and sell the product? A simplified way of looking at this is how many “person-months” will be involved? (Use whole numbers and a minimum of half a month.)

To get the score, multiply Revenue by Confidence and then divide that number by the Effort.

Once every idea is scored, results can be tabulated and prioritized:

Bespoke Prioritization Frameworks

We can build more complex scoring models too. For example, we recently coached one company through a new product prioritization exercise and we started with a very long list of potential evaluation criteria. We then narrowed the list down to the most critical and weighted each metric. For example, ability to land new customers was weighted more highly than payback period. We also created a two-step process that first eliminated ideas that didn’t meet a set of must-haves or "litmus tests" such as the market size before scoring ideas.

Criteria can include anything important to our business goals, for example, new customer acquisition, margin improvement, revenue growth, etc. Some organizations give each criterion a weight because some are more important than others. As always, the leadership team needs to be aligned on how the criteria are defined for this to work well.

3. Look at the totality of ideas to ensure there is a strategically balanced mix of “easy wins” and longer-term transformational ideas

After scoring each idea, it’s useful to visualize the portfolio of options to see where the best options are and to see if we have a well-balanced portfolio. Deciding ahead of time how you want to balance your new product investment portfolio across different categories is akin to deciding how to allocate your personal investment portfolio across various asset classes. Less risk-averse? Have more small-cap or emerging market equities. More risk-averse? Allocate more of your portfolio to bonds and dividend-generating large-cap equities.

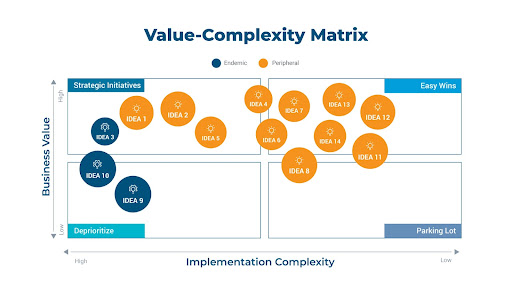

For example, one organization plotted the ideas on a matrix with complexity along one axis and business value along the other. Next year’s revenue impact, a third dimension, was represented by the size of the bubble:

Ideas that have low business value and high complexity are “Deprioritized.” Ones with high value and low complexity are “Easy Wins.” They are immediately pursued, as are the “Strategic Initiatives” with a longer payoff period due to their higher complexity.

The leadership team must agree on what percentage of new product development should be “Easy Wins” ideas and what percentage should be “Strategic Initiatives.”

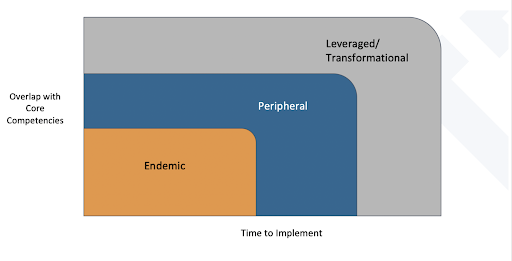

Another way to think about portfolio allocation is to look across three innovation categories: Endemic, Peripheral, and Leveraged. Endemic ideas are innovations in existing products or services. Peripheral ideas are ones that are adjacent to existing services. Leveraged or Transformational are entirely outside the core business and often require the most time and are the most disruptive.

Again, the leadership team needs to decide what percentage of the new product development budget will be spent on Endemic ideas versus Peripheral versus Leveraged/Transformational. Recent benchmarking research from KPMG found that the best innovators are spending more of their innovation budgets on transformational innovation than less successful innovators. In fact, the most successful innovators allocate 37% of their portfolio to transformational/leveraged innovation.

4. Revisit the assumptions we’ve used to make these decisions at least quarterly, and re-prioritize as needed

We also want to establish a regular cadence of reviewing the progress of our new product ideas and reallocating resources based on new information. As we learn more about the market, and the product development requirements, our potential and complexity scores will change. We recommend meeting monthly to review the portfolio when you are getting started and quarterly after you have an established portfolio of both existing and new products you are managing.

Ask for Help

Even when following the four steps, we might need some outside facilitation and expertise. Vecteris offers an Innovation Portfolio Assessment to help identify and score new product ideas. Our clients find that it helps to have an external facilitator help kill some sacred cows and ensure the team sticks to a disciplined prioritization process.

Please feel free to email me to learn more.